ORIGINAL MEDICARE "DEDUCTIBLE" IS DETERMINED BY THE UNITED STATES

GOVERNMENT on an annual basis

The annual

deductible

for all Medicare Part B beneficiaries is $226 in

2023

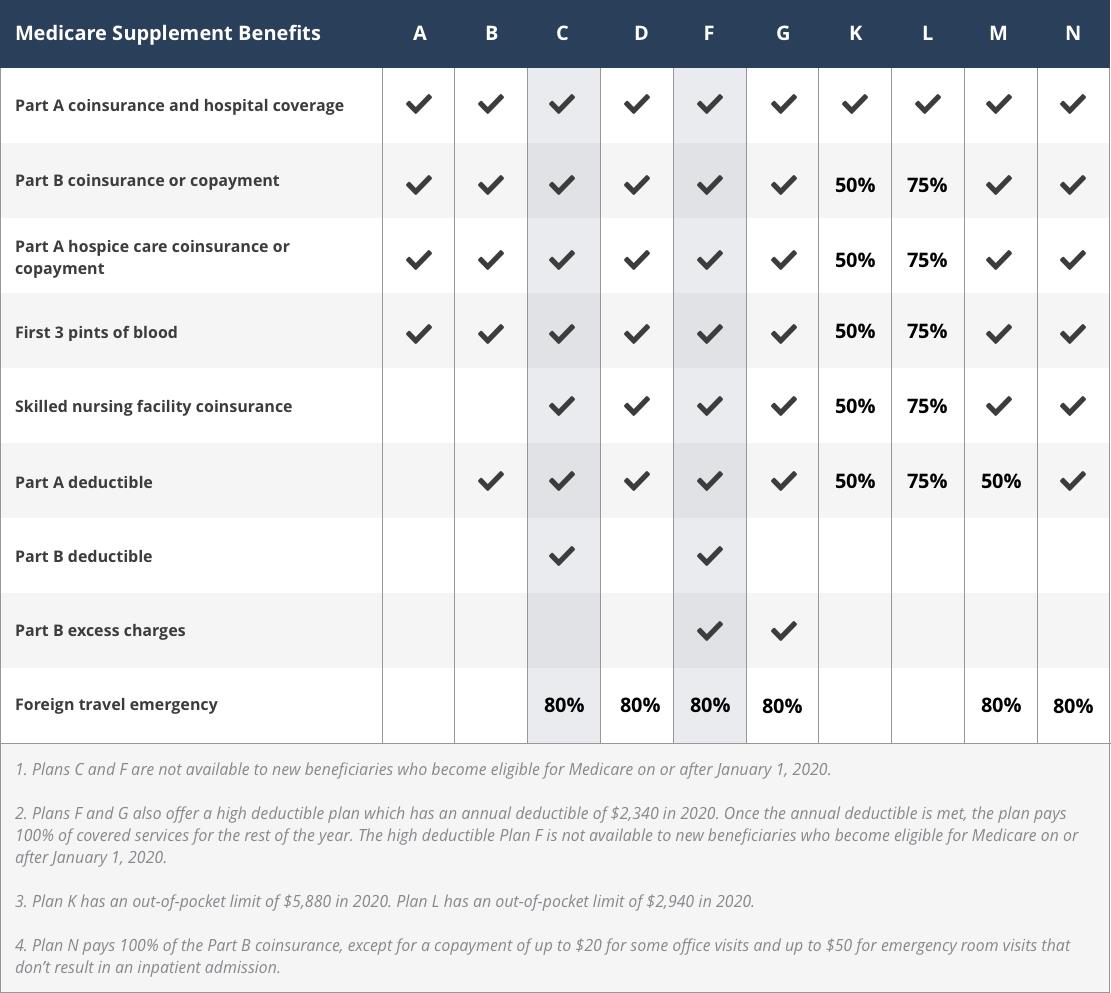

Plan A - Hospital Coverage

Plan B - Office vistits and non-hospital visits (x-rays, tests,

etc).

Meaning that some hospital procedures may be included

in Part B and not Part A

Plan C - is NOT ORIGINAL MEDICARE.

Plan C is also ONLY available for people who because eligible on, or

before, January 1, 2020

Plan D - ALL pharaceutical plans that ARE SUPPLEMENTAL to ORIGINAL

MEDICARE

Plan F - IS NOT available for people who because eligible on, or

before, January 1, 2020. Plan F covers everything - including coverage for

annual deductible.

HOWEVER, if you became eligible before 2020, you may be able to enroll in

Plans F or C as long as they are available in your area.

Plan G - Pays 100% of EVERYTHING not covered by Plans A&B

AFTER the annual deductible is met/paid

Plans F and G

offer a HIGH DEDUCTIBLE option of $2700 per year (the deductible is set by the US Government on an annual

basis). Once deductible is paid, 100% of covered expenses are paid

Plans F and G are the ONLY Medigap Plans that pay Excess

Charges (Charges "allowed" by Original Medicare, but OVER acceptable)

Plan K - has an out-of-pocket yearly limit of $6940 (this

limit is set by the US Goverment on an annual basis). After the $6,940 is

paid, insurance pays everything at 100% for the calendar year

Plan L - has an out-of-pocket yearly limit of $3,470 (this

limit is set by the US Goverment on an annual basis). After the $3,470 is

paid, insurance pays everything at 100% for the calendar year

Plan M -

Deducibles and ALL excess charges are the

responsibility of the patient

Plan N-

Pays 100% of Part B coinsurance, except for a

copayment of up to $20 for some office visits and up to $50 copayment for

emergency room visits that are so not result in an inpatient admission

________________________________________________________________________

Cost of Medigap plans vary, depending on the company that is selling the

plans AND depending on what area the patient lives in.

If a person moves,

they have to "re-do" Medigap AND Advantage coverage to "meet" the new

location.

Medicare guides and availabilities. Massachusetts, Minnesota and Wisconsin have different Medigap standards

There are 9 standardized benefits included in

consideration of purchase of Medigap Plans:

-

Medicare Part A coinsurance and hospital costs

Medicare Part A covers hospital costs IF patient is admitted to

a hospital for inpatient treatment, after you reach the Medicare Part A

deductible of $1600 per year.

Patients are not require to pay the Part A coinsurance of $1600 for

the first 60 days of a hospital stay

HOWEVER, on day 61 of the hospital stay, Patients are required to pay

"Medicare Part A coinsurance" at a cost of

$400

per day through day 90.

After 90 days in the hospital, patients must pay

$800

per day for up to 60 more days. After a total of 210

days in the hospital Medicare no longer covers, and a patient becomes

responsible for all hospital costs.

-

Medicare Part A deductible

Before your Part A coverage kicks in, you are required to pay

the Part A deductible ONLY IF a patient has a hospital stay of more than

60 days. The Medicare Part A deductible isn't an annual deductible -

this deductible is PER hospitalization. This means that you could

potentially have to meet the Part A deductible more than once in a given

year.

-

Medicare Part B deductible

Before Medicare Part B covers any of your costs for things like

doctor's appointments, x-rays, tests, medical devices, etc., a patient

has to pay the annual deductible. $226 in 2023. The US Government sets a

new deductible each year.

-

Medicare Part B coinsurance or copayment

After Part B deductible is met, a patient is required to pay a copay of

20% of Medicare-approved amounts for your COVERED

SERVICES. There is no limit to how much you may be required to pay for

this 20 percent copayment or coinsurance in a given year, if you do not

have a Medigap plan that provides coverage for this cost.(MAKE SURE that

your doctor, clinic, hospital is CONTRACTED to accept Medicare!!!!!

-

Medicare Part A hospice care coinsurance or copayments

If a patient receives hospice care that is covered by Medicare,

you are required to pay a Part A copayment for prescription drugs you

use during hospice. You may also be charged 5 percent coinsurance for

inpatient respite care costs.

-

Coinsurance for skilled nursing facility

There is no coinsurance requirement for the first 20 days of

inpatient skilled nursing facility care. However, a

$200 per day

coinsurance requirement begins on day 21 of your stay, and you are then

responsible for all costs after day 101 of inpatient skilled nursing

facility care (in 2023).

-

Medicare Part B excess charges

Excess charges can be accrued when a

patient receives Medicare-covered services or items from a provider who

is not contracted with Medicare. This means that a provider may not

accept Medicare payment as full payment for their services. In this

case, the provider can reserve the right to charge the patient up to 15%

more than the Medicare-approved payment.

-

First three pints of blood

Original Medicare does not provide coverage for the first three

pints of blood that are used in a blood transfusion.

-

Foreign travel emergency care

Medicare does not typically provide coverage for emergency care

received outside of the U.S. or U.S. territories.